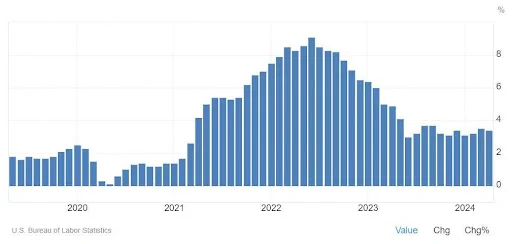

The prices of goods and services were out of control in 2021 and 2022. Egg prices rose by 59.9% between November 2021 and a year later, with elementary and secondary school meals spiking 305.2% during the same period.

This was all thanks to rampant inflation.

The Consumer Price Index (CPI) hit 9.06% in June 2022 (the highest in 40 years), compared to just 0.12% in May 2020.

Inflation is a consequence of the price of goods and services rising over a sustained period, eroding the purchasing power of earnings and savings.

The inflation rate has since dropped off to a more reasonable 3.36% in April 2024, still some way off the Fed’s target of 2%. But if you think the price of goods and services is still unreasonable, you’re on to something.

Despite the drop in inflation, prices rose by 20.8% from February 2020 to 2024. Even the best high-yield savings accounts don’t provide such yields, so your savings would feel the pinch of the inflationary pressures.

So, could cryptocurrencies guard your savings against the ravages of inflation? Let’s find out.

The Threat of Inflation on Your Savings

It is actually desirable for the prices of goods and services to rise over a number of years. But inflation must be moderate for it to benefit a country.

High inflation is triggered by the rapid rise in prices, while deflation, where prices are falling, means the economy is stagnant, experiencing little to no growth. Moderate, stable, and predictable inflation is good as it allows business owners to keep growing and pay their workers higher wages.

When inflation rises, it erodes the dollar’s value, eating into the buying power of your money. If your savings do not grow at the same rate as inflation, you are losing money. You won’t have the capacity to keep up with the cost of living, as inflation curtails your ability to purchase as much as when you began saving.

If you are saving for retirement, you won’t meet your target unless you keep saving more to beat inflation. But that will be a lot harder since commodity prices will rise, making it more difficult to save an extra coin.

The only way to beat inflation is to place your savings in an investment offering a higher interest rate than the inflation rate, and that’s where cryptocurrencies could come in handy.

Characteristics Favoring Cryptocurrencies’ Inflation Protection

Normal/fiat currency is susceptible to inflation because it is subject to manipulation. A country’s Central Bank can print more money in the face of undesirable economic climates.

An example is when the US printed money in 2020 and handed out about $1 trillion collectively to individuals as part of the COVID-19 stimulus package. This partly contributed to the consequent 40-year high inflation rate.

Here are some features that make crypto the go-to solution for fighting inflation:

1. Limited supply

Unlike the case of a Central Bank printing a limitless supply of a fiat currency, most crypto have a predetermined maximum supply in their code. They are finite resources, creating scarcity.

Crypto scarcity is ripe ground for a potential hedge against inflation, as demand for the limited supply could lead to an increase in value.

Bitcoin, with a lifetime supply of 21 million coins to be mined by the year 2140, is a prime example. Research provides evidence that Bitcoin prices usually appreciate against inflation shocks.

2. Decentralization

Cryptos are also free from Central Bank manipulation. They operate on decentralized networks that are not controlled by any entity. This allows cryptos to operate independently. A Central Bank can implement fiscal control by printing more money, leading to inflation.

3. Transparency

The blockchain allows for transparency by displaying all transactions made using a particular crypto. Further, the transaction information is immutable (can’t be changed).

Independent parties can track and ascertain all transactions, making it harder to arbitrarily increase a crypto’s supply without detection. These measures ensure a stable operating environment, reducing the probability of supply inflation.

4. Deflationary tendencies

With time, cryptos are burned while in use. Others are locked in wallets and passwords are forgotten, never to be retrieved. This removes them from circulation, making the crypto deflationary and creating further scarcity.

A WSJ analysis suggests there are about 20% or 1.8 million “lost” Bitcoin worth nearly $20 billion, and it is highly unlikely they’ll be recovered.

How Has Crypto Performed During Inflationary Periods?

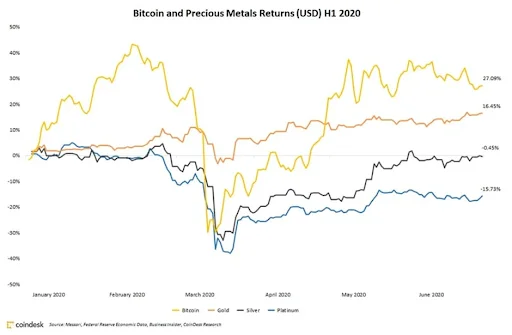

Yes, cryptos are volatile, but they have displayed some resilience in the face of high inflation. For instance, in the first half of 2020, Bitcoin rose by 27%, higher than gold, silver, and platinum, which have long been the traditional hedges for inflation.

Despite gaining 16% during the same period and reaching 8-year highs in June, gold still underperformed the crypto by nearly 11%. Platinum and silver registered negative gains during this time.

This was during a recessionary period, with inflation rising from 1.6% in June 2019 to 2.5% in January 2020, then dropping sharply to 0.2% in May 2020 before rising to 40-year highs in 2022.

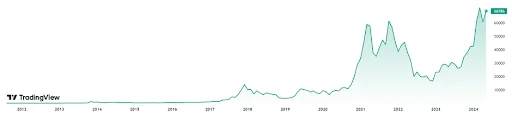

For a while, cryptos did well despite rising inflation in 2020 and 2021, with Bitcoin gaining 60% in returns in 2021. Most cryptos were affected by high inflation rates due to diminished purchasing power and devaluation of the dollar.

But when inflation kept soaring and blew past the 9% mark in 2022, cryptos and even commodities felt the heat and plummeted in value. With investors seemingly scared of the riskier investment, Bitcoin lost 64% of its value in 2022.

However, when the Fed eased off its interest rate hikes in 2023, and the CPI cooled to a more manageable yearly average of 3.4%, the narrative changed. Bitcoin gained 156% of its value YoY in 2023, with prices rising to $43,700 in December 2023, up from lows of $16,529 in December 2022.

Overall, cryptos are too new to provide a definitive answer to their claim as a hedge against inflation. Research shows cryptos have positive real returns correlated to inflation but not nominal returns. This suggests cryptos can stop an investor’s money from losing purchasing power as a result of inflation.

Using Bitcoin as an example, the evidence for or against the assertion that cryptos are a hedge against inflation is erratic. Its price performance over time has not supported either thesis conclusively, as it remains relatively untested in diverse economic scenarios.

How do cryptos compare to traditional assets?

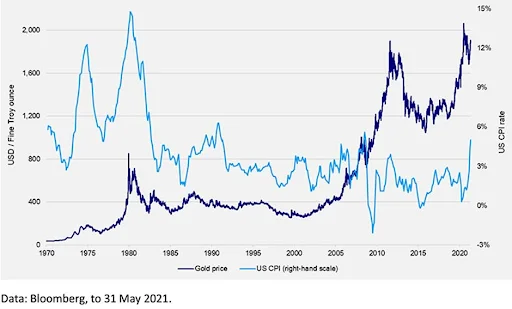

There’s no definite correlation between precious metals price performance and inflation. Sometimes, they lose or gain value, all dependent on market sentiment.

For instance, gold gained by nearly 600% between 2000 and 2011, when the inflation was relatively stable, but lost nearly half its value from 2011 to 2016, when the inflation rate was around the Fed’s long-term desired inflation target of 2%.

In 2021 and 2022, when the CPI was 7.2% and 6.4%, gold sank by -3.5% and -0.1%, respectively, but rose 13.4% when the CPI dropped to 3.3% in 2023. Gold reached an all-time high of $2,449 per ounce in May 2024, with inflation hovering around 3-4%.

An ETF that has been tracking the price of gold reported returns of 5.5% annually compared to 15.3% for the S&P 500 for the past 15 years. Although stocks typically perform poorly with rising inflation, they can act as a hedge against inflation in the long run.

Data tracking the S&P 500 shows the largest 500 capitalization stocks gained 10.7% on average since its introduction in 1957, but the average yearly inflation rate from 1914 to 2023 is 3.3%.

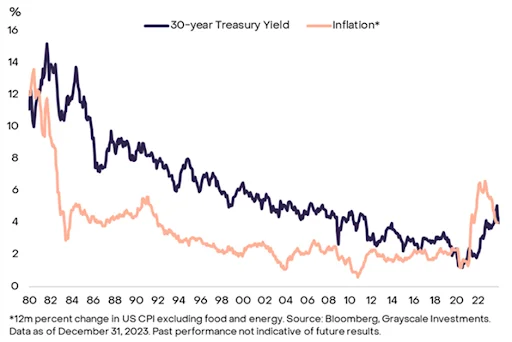

Bonds have also been perceived as a good store for value. They are a source of stable yet small gains. Although bonds yields steadily declined since the 80s, so did inflation, leading to sustained bonds yields over the years.

However, minor gains in bonds usually mean they will underperform in the face of strong inflation. If you invest in bonds with 4-6% yields, your investment will lose value faced with 8-9% inflation rates. As seen in recent years, investors have lost at least 1% of their bonds values annually from 2019 to 2023.

Crypto Portfolio Inflation Protection Strategies for Physicians

Investors must gauge the risk/return tradeoff before deciding which cryptocurrencies to invest in. Fixed income assets offer less risk but provide less returns compared to cryptos.

For example, Bitcoin has annual returns of 50% against 75% volatility, while Ethereum provides annualized returns of close to 80% and annualized volatility of 90%. By contrast, fixed-income investments offer less than 10% in annualized returns and volatility.

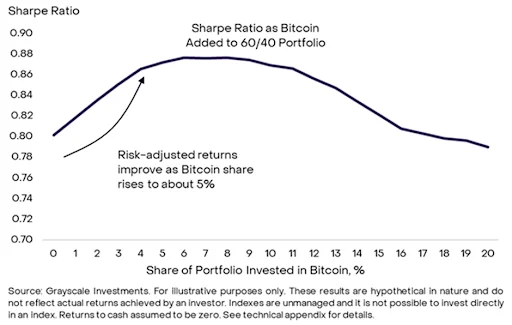

Using Monte Carlo methods and holding a 60/40 stocks and bonds portfolio, a simulation shows adding Bitcoin worth 5% of the total portfolio value offers the optimum Sharpe Ratio, a measure for risk-adjusted returns.

The Sharpe Ratio keeps rising until it gets to 5% before leveling off, showing no improvements in risk-adjusted returns after this mark. Although not entirely accurate, the results suggest holding 5% of Bitcoin in your portfolio is the optimal ratio for risk/returns.

1. Diversification across cryptocurrencies

The best way to mitigate cryptocurrency volatility is to spread your investments across several cryptocurrencies and blockchain assets like NFTs.

This should guard against the risks of investing in a single crypto and reap the rewards of emerging trends. For instance, NFTs had a great run in 2021 through 2022, with the top 10 most expensive pieces being sold for over $7 million during this time.

2. Consider Risk Tolerance and Investment Timeframe

What are your investment objectives? Do you wish to gain wealth in the long term, or are you seeking the thrill of short-term gains? Your goals should help determine which investment strategy to settle on based on the volatility prospects of each asset.

Also, conduct an honest review of your risk tolerance to establish your comfort level. It will help you choose a crypto or asset aligned to your investing style and minimize chances of abandoning strategy mid-investing.

3. Investing strategies for managing volatility

- HODL: This refers to the long-term buying and holding of crypto. The strategy aims to ride out the price volatility, which will iron out to the investor’s advantage over time. A study of Bitcoin’s price since its inception points to an upward trajectory if held over a long stretch.

- Dollar-Cost Averaging: A practice where you make small amounts of recurrent purchases following a set schedule. This relieves the pressure of having to time the market or missing out on opportune moments to buy. In the long run, it reduces the impact of volatility. Investors may make extra purchases when there are significant market dips.

- Active trading: If you have the time, score short-term gains by frequently buying and selling crypto to exploit crypto volatility. This strategy requires extensive market research and is the most high-risk tactic.

Considerations and Risks

The most common risks and considerations include:

- Volatility: The bane of every investor. Cryptocurrencies are notoriously volatile, so prepare a strategy to mitigate this risk and avoid being swayed by emotions.

- Security: There were 283 crypto theft incidents in 2023, with $24.2 billion received by illicit addresses. As of 15 January 2024, $8.37 million worth of crypto had already been reported stolen. Ensure you install sufficient security measures to prevent incidents of hacking and fraud.

- Regulatory: It is still a relatively new market, so new regulations keep cropping up in different states as legislators come to grips with cryptocurrencies. These new laws may introduce unforeseen risks.

Can Crypto Be Your Inflation Shield?

Most cryptocurrencies have a fixed supply that promotes scarcity. Additionally, they are based on decentralization, suggesting they are prime candidates for inflation protection.

However, being new entrants in the market, they have not yet faced wide-ranging economic scenarios. The data on their performance amidst rising inflation is limited, so it is impossible to draw conclusions on their efficacy as solutions against inflation.

Like any other investment class, cryptocurrencies come with some level of risk. If you intend to spend large sums on purchasing some in an effort to beat inflation, it is in your best interest to seek the services of a financial advisor with crypto experience.