Central Bank Digital Currencies (CBDCs) are a new entrant in the world of finance, even newer than cryptocurrencies. They are a type of currency promising faster transaction speeds at a lower cost than traditional currency.

At their core, CBDCs are digital currencies that operate on the blockchain, like cryptos. So, are CBDCs a plot by Central Banks to replace crypto, or are they designed to work alongside one another?

This article examines CBDCs and cryptocurrencies and their use cases and investment options for physicians.

The Concept of CBDCs

The most common medium of exchange we are conversant with is fiat currency, typically in the form of banknotes and coins. A CBDC is the digital currency equivalent of fiat currency—it has all the functionality and utility of fiat currency but in a digital form.

97% of the money currently in circulation is in digital format, mostly from checking deposits. However, CBDC differs from normal digital cash because it is a direct liability to the Central Bank, like coins and paper money.

CBDCs operate like cryptocurrency—users utilize digital wallets for transactions, which are recorded in a blockchain database. Unlike cryptos, CBDCs are managed by Central Banks. This is aimed at enabling the government to manage money more effectively.

They eliminate the threat of private entities controlling a country’s economy. For instance, Alipay and WeChat Pay account for 94% of all Chinese online transactions, which could lead to anticompetitive tendencies.

The leading CBDC, e-CNY, digitalizes some of China’s physical coins and notes that are already in circulation. e-CNY allows users to make e-yuan payments even in offline stores or without a charged phone. Like fiat currency, CBDC systems don’t require intermediaries to process payments, boosting efficiency and lowering costs.

CBDCs offer the same convenience as cryptos, and since they are backed by the Central Bank, they are more trusted. Its inherent properties have led to more widespread research and adoption of CBDCs.

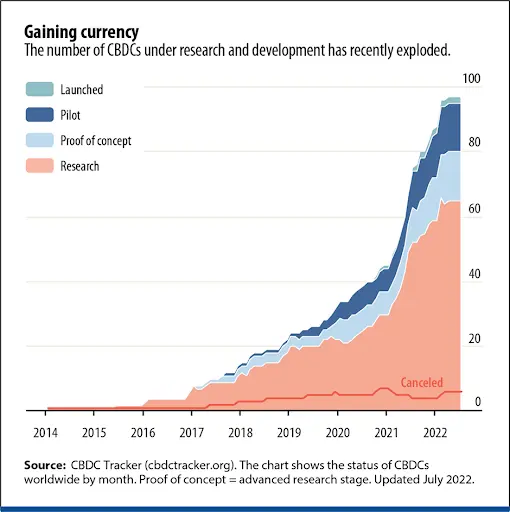

Rise of CBDC usage

Source: https://www.imf.org/en/Publications/fandd/issues/2022/09/Picture-this-The-ascent-of-CBDCs

Benefits of CBDCs

1. Increased stability

Cryptos are highly volatile since they are subject to market sentiment, and there is no regulatory body monitoring their performance. On the other hand, CBDCs have a central bank monitoring and regulating them, ensuring price stability.

For instance, when the US faced 40-year high inflation rates of 9.1% in June 2022, and the dollar index hit 20-year highs of 112.12 in September 2022, the Federal Reserve (The Fed) raised interest rates by 5.25% points between 2022 and 2023 in a bid to stabilize the dollar.

These measures have seen interest rates cool down to 3.36% in April 2024, although it is still not at the Fed’s target rate of 2%. The dollar index has since lowered to 104.43 in April 2024. A central bank can do the same for a CBDC since it controls it.

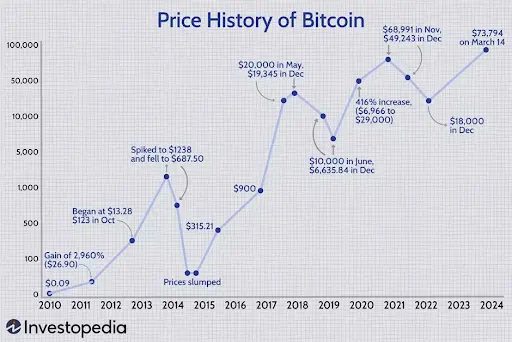

Cryptocurrencies have no entity controlling them, so their prices can rise and fall seemingly on a whim. For example, Bitcoin’s price hit $69,000 on November 10. 2021. By December 31, 2021, it was trading at $46,208. In January 2023, its price was $16,530, but it rose to $42,258 by the close of that year.

Bitcoin’s price swings

Source: https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp

2. Easier integration with traditional finance

Central Banks have designed CBDCs to operate seamlessly with the available cryptocurrencies and blockchains, which could enhance interoperability between digital and traditional finance systems.

3. Legitimacy

Cryptocurrencies are plagued by legitimacy concerns since no one controls the blockchains in which they operate. CBDCs are a cure for this as central banks regulate them, encouraging more people to invest in them as there is a familiar entity to ensure fairness in dealings.

A poll covering 13 countries found that most respondents prefer digital currencies issued by their central banks rather than private entities (by 13 percentage points). They also inferred that safety and privacy are the most essential features of a digital currency, even more important than convenience.

4. Regulatory compliance

Since CBDCs are developed by Central Banks, they are more likely to adhere to regulations. The banks give clear guidelines on their usage, eliminating uncertainty.

Regulators are still coming to terms with crypto, so they keep on enacting laws that could be detrimental to their development and operations.

5. No need for a bank account

6% of US adults are still unbanked and often rely on costly alternatives like money orders and payday loans. CBDC eliminates the need for a bank account to transact. All you need is a smartphone and a smart wallet to access your cash and transact at much lower fees.

Drawbacks

1. Centralized

CBDCs are subject to government control, unlike decentralized cryptocurrencies. The disadvantages of centralization include:

- Vulnerability to cyberattacks and hacking. The servers are in a centralized platform under the control of a single entity, so the information could be easily accessed once breached. Crypto, on the other hand, is stored in several decentralized ledgers under no one’s control, and the data is immutable. Any unauthorized changes to the data are rejected.

- Lack of transparency. The Bank decides what information on transactions it will disclose, unlike cryptos.

- Manipulation by the Central Bank. Centralized monetary systems can be controlled by a central bank. They can make decisions in their best interests instead of letting market forces dictate pricing, as happens with cryptocurrencies.

2. Privacy concerns

They also come with the baggage of diminished privacy, which is hard-baked into cryptocurrencies. Moreover, CBDCs offer none of the finality or privacy protection of hard cash. The Bank does not know what dollar bill a person has. However, it can access information on the users of each CBDC and use that information as it deems fit.

How Can Physicians Invest in CBDCs?

CBDCs operate like cryptocurrencies, so most of the investment avenues applicable to crypto will likely work on them. Although CBDCs have limited investment opportunities since they are a relatively new concept, they present prospects for direct and indirect investments.

China launched e-CNY in January 2022 in 11 pilot areas, with special emphasis on trials in venues used in the Beijing Winter Olympics in February and March. Following its success. The central Bank has now run test pilots in 23 cities.

As of October 2021, 123 million individual and 9.2 million corporate wallets were operational, with a cumulative transaction value of about $8.8 billion. Although they have not released official figures, Central Bank officials estimate that by March 1, 2022, 261 million wallets were in operation, with transactions hitting approximately $14 billion.

Since then, the central bank governor says transactions grew to $249.33 billion by the end of June 2023, up from about $13.8 billion in August 2022. This growth was spurred by 950 million transactions. Interestingly, this only accounts for 0.16% of all China’s cash in circulation, so there’s still plenty of room for growth.

By buying shares in companies or projects that facilitate payment, growth, or asset management solutions for CBDCs, an investor could see their investment grow with mass adoption. For example, Project Cedar is developing a platform enabling cross-settlement of wholesale cross-border multi-currency payments.

Alternatively, you could invest in an organization that could potentially utilize the CBDCs. These include banks that have expressed an interest in adopting the new tech. FinTechs involved in digital payments are also likely to use it more often once it gains widespread usage.

Like crypto, an emerging investment class for CBDCs is exchange-traded funds (ETFs). These will track the price performance of the CBDCs, allowing investors to speculate on the price movements of foreign exchange and currency markets.

Like FX trading, users can buy and hold on to a CBDC in the hope that it will increase in value. If it does, the investor can sell it for a profit.

Though difficult, the key is to monitor trends, developments, and financial news to find the opportune time to make the investments.

What are Cryptocurrencies?

Cryptos are also digital currencies whose transactions are recorded, verified, stored, and run on a decentralized system of distributed public ledger called the blockchain. Before any transaction is recorded, it must be agreed upon by the nodes that maintain the ledger. Cryptos facilitate secure digital payments and can also be used for investing.

How Physicians Can Use Crypto to Manage Their Finances

Physicians can utilize crypto in several ways:

1. Savings for the practice

One of the underrated uses of crypto or the blockchain is its ability to minimize costs since no intermediaries are used to transfer the funds.

For example, the World Food Program implemented the Building Blocks blockchain pilot program in Jordan in 2017, which enabled the organization to save $2.4 million in reduced administrative and transaction costs.

2. Streamline operations

The healthcare industry faces widespread inefficiencies, with experts estimating it loses 25% in wasteful spending annually. Inefficiencies in the supply chain also add up to 50% in operational costs.

The blockchain can replace and hasten the manual inventory management process, which is error-prone and requires frequent upkeep. Using the blockchain might improve the tracing of supplies, and smart contracts can trigger supply chain operations like ordering supplies, reducing operation time and reliance on third-party verification.

Streamlining operations is such a crucial part of doing business that a survey shows that 70% of retail and manufacturing businesses have started shifting to digital supply chain operations.

3. Yield farming

If you have some cash lying in a low-interest bank account and have the appetite for a high-risk high-return venture, try yield farming.

It is a form of investing otherwise known as liquidity mining, where you can lend your crypto assets or set a smart contract that automatically moves your crypto holdings to a blockchain network paying the highest interest. Yield farms can offer annual percentage yields (APY) of over 200% compared to Bank APY’s of 1-4%.

Since crypto prices are highly volatile, prone to interest rate fluctuations, and smart contracts can fail, this is a risky venture. Token pools like Venus, Uniswap (V3), Curve Finance, and PancakeSwap (V2) offer reasonable returns.

4. Staking crypto

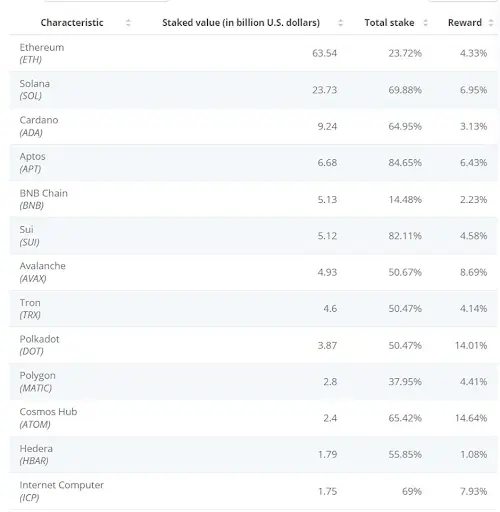

Another passive way to earn some returns is to lock your crypto assets on a certain blockchain and agree not to sell or trade it (staking). For example, about 27% of all the Ethereum is staked as of May 30, 2024.

Biggest cryptocurrencies based on total staked value as of December 5, 2023.

Source: https://www.statista.com/statistics/1279011/crypto-staked-value/

You will receive interest or rewards in return. Data from Statista shows rewards can go as high as 19.7%.

Benefits of Cryptocurrencies to Physicians

1. Lower fees

Crypto transaction costs can be lower than traditional bank charges, especially for international transfers. A physician can take advantage of this when processing and paying for supplies from abroad.

2. Faster turnaround

Some payment options, like wire transfers, have long wait times, often lasting 1 to 2 business days. You can complete a transaction on the blockchain in a matter of minutes, even when sending money to offshore suppliers.

3. Immutability of records

Data is recorded on the blockchain, and it cannot be changed. This enables secure storage of sensitive information, like patient records, or data prone to manipulation, like inventory figures.

Drawbacks

1. Limited acceptance

CBDCs are supplied by the country’s Central Bank, so they are legal tender. Some countries may limit the usage of cryptocurrencies, while countries like China, Bolivia, and Saudi Arabia have banned crypto usage entirely.

2. High risk

Compared to most other options, cryptocurrency investing is one of the riskiest. It is subject to extreme volatility and regulatory uncertainties.

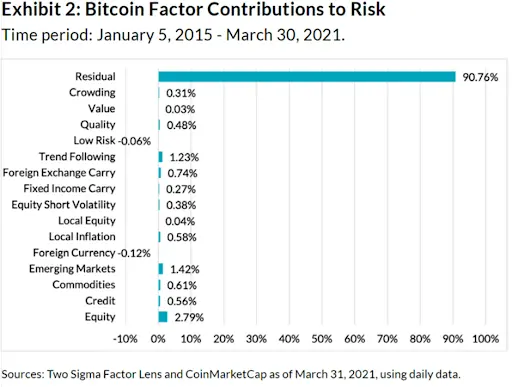

Using a Two Sigma Factor Lens, not including the crypto factor, 90.76% of Bitcoin’s risk between January 2015 and March 30, 2021, is inexplicable. By comparison, the S&P 500 showed a less than 1% residual risk over the same period.

Bitcoin’s risk

Final Word

The best investment vehicle for your particular case will depend on your risk appetite. If you are risk averse, investing in CBDCs could be the right move. The Central Bank is directly liable for it, and its value is usually pegged on the national currency, enhancing price stability.

If you have the stomach for higher risk, cryptocurrency investing is the way to go. Market forces dictate crypto prices, so there’s potential for higher returns. Besides investing, crypto could help cut transaction costs and streamline operations by automating some tasks in supply management.