Gallup released a report on Americans’ favorite long-term investment options. The findings showed that the top 3 investment assets were real estate, gold, and stocks.

Investing in either one of these could prove a prudent decision, but which is best?

The statistics show at least 65.9% of Americans own their homes, while 61% own stocks. Only 38% of retail investors have ownership of physical gold. Considering a survey asserts that 40% of American adults now own cryptocurrencies, we’ll include it in this analysis.

We’ll provide all the top reasons for investing in each of these assets, possibly helping you determine the best option.

A. Why Invest in Real Estate

In the 2023 Gallup report, 34% of Americans thought real estate was the best long-term investment. And it’s easy to see why.

Real estate is often at the apex of passive income streams, as its value generally increases over time and helps its owners build equity. Further, real estate is a great hedge against inflation since a rise in inflation almost always means an increase in prices, delivering positive returns in the long run. Here’s why you should consider investing in real estate:

1. Appreciation

Fluctuations in interest rates influence the mortgage rate and real estate affordability, consequently impacting demand for real estate. The current 30-year fixed mortgage interest rate average of 7% is partly to blame for the stratospheric rise in housing prices.

Predictably, housing affordability has been on the decline. The National Association of Realtors (NAR) found that a 7.7% increase in monthly mortgage payments in March 2024 year-over-year (YoY) contributed to a 4.7% increase in the median home price.

Despite all this, home prices continue to rise, reaching all-time highs of $552,600 in Q4 2022 and still persist beyond the half million mark to date. Even with the stubbornly high mortgage rates, home sales remain beyond the 4 million mark, only dropping below this once in 2023.

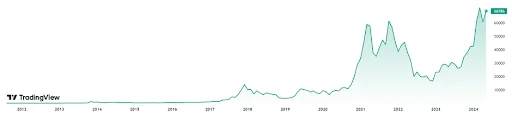

Real estate performance over time

Source: https://www.redfin.com/news/housing-market-value-hits-record-high-2023/

2. Hedge against inflation

Generally, a strong economy fuels housing demand as more people have the money to buy homes, and the opposite is true.

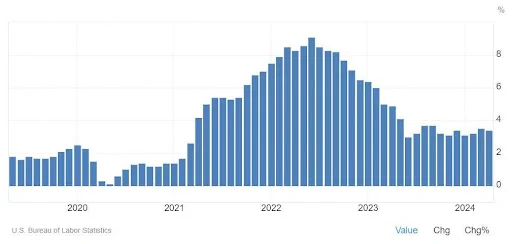

For instance, the US economy faced headwinds in the past four years, with the economy contracting for consecutive quarters in 2022 and 2023, hitting lows of -2% in Q1 2022. The Federal Reserve (Fed) instituted a series of interest rate hikes in a bid to tame runaway inflation.

Despite this, median rent prices hit all-time highs of $2,054 in August 2022. Home median sale prices also reached all-time highs of $432,525 in May 2022 and still lurk beyond the $420k mark to date.

3. Diversified portfolio

You might think the real estate industry is a monolithic investment path limited to buying and selling property, which is a preserve of the rich. However, it is much wider than this, enabling even investors of modest means to dip their toes in the industry:

- Renting out property: Purchase and let rental property. Use the proceeds of the rent to pay the mortgage fees. Only 65.7% of American adults own their own home as of Q4 2023, so there’s still plenty of market for rental housing.

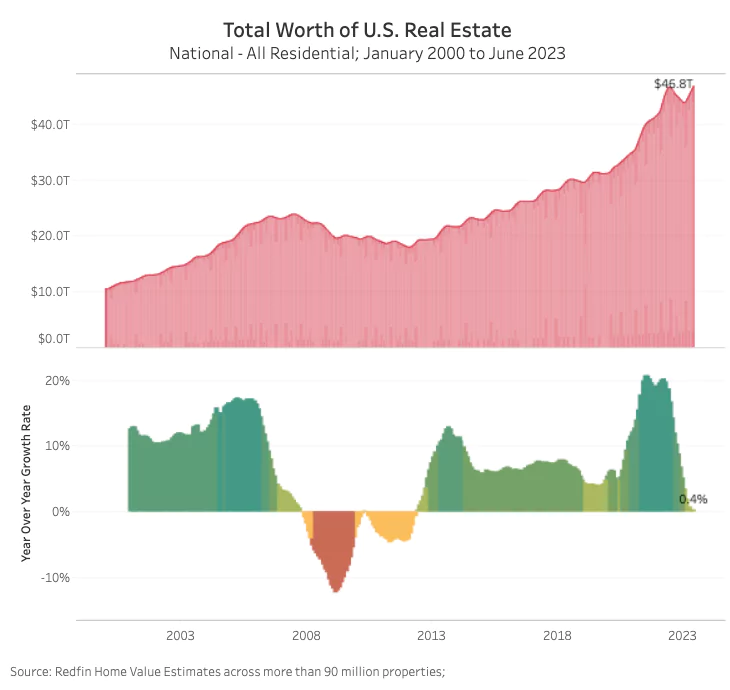

- Real Estate Investment Trusts (REITs): Combines the liquidity of a stock with the ease of owning…a stock. Investors earn returns from real estate appreciation and dividends, too. National Association of Real Estate Investment Trusts data shows REITs outperform stocks on 20-50 year horizons, providing 12.7% annual returns vs 10.2% average stock market return from the S&P 500 between 1972 and 2023.

Nareit performance.

Source: https://www.fool.com/research/reits-vs-stocks/

- Real estate platforms: These platforms unite investors with developers seeking capital to finance projects. While some only allow accredited investors, some take advantage of fractional ownership, allowing investors to only purchase a fraction of the property. Fractional ownership has found some usage in the blockchain, enabling the tokenization of real estate properties.

B. The Case for Investing in Crypto

Cryptocurrencies have acquired a bad reputation for volatility, but high risk can come with great rewards. Understanding the characteristics of this emerging market could potentially hold the key to higher returns.

1. Potential for high returns

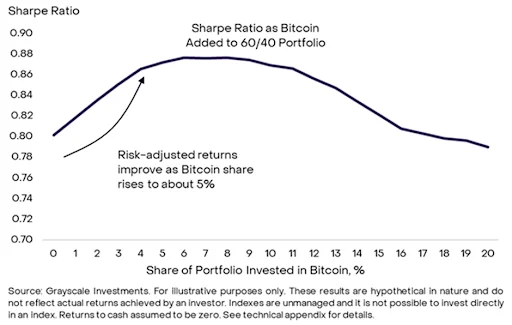

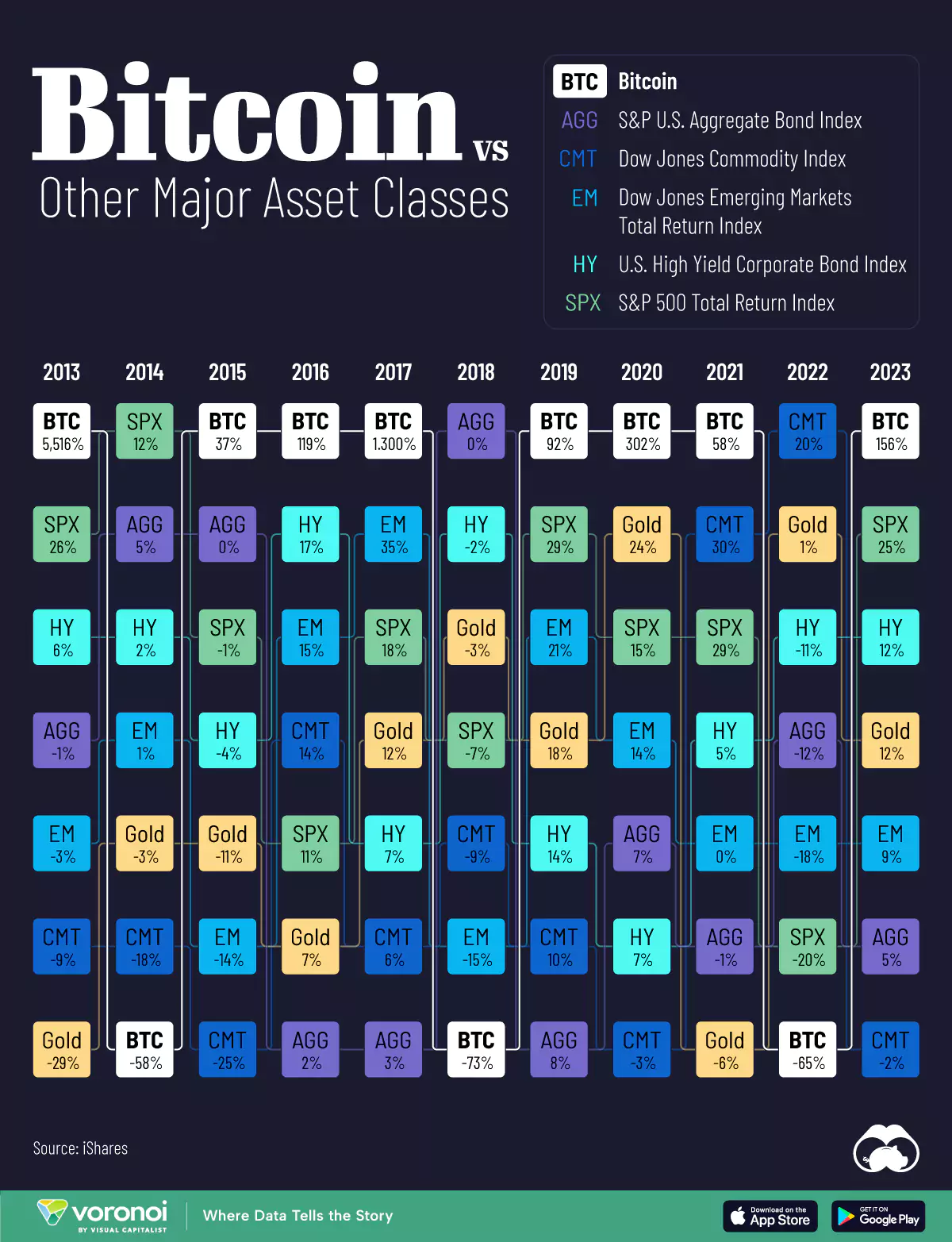

Most cryptocurrencies, like Bitcoin, have a supply cap. A limited supply creates scarcity, which might increase its value over time.

Bitcoin also has halving events, which slows down its rate of production. These halving events have historically led to increases in Bitcoin prices.

After the first halving event in 2012, Bitcoin’s price rose by 145% in the first 90 days, 982% after 180 days, and 7,851% a year after. On average, its price has increased by 2,908% a year after each halving. Even the most conservative uptick happened during the second halving, where the price appreciated 279% a year later.

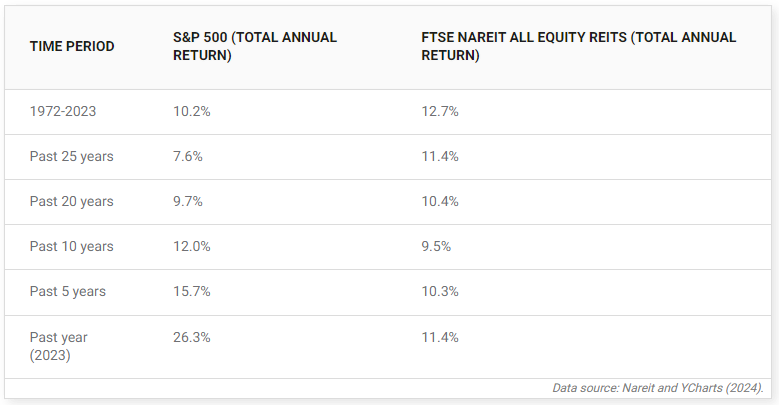

Bitcoin has outperformed all other major asset classes in eight of the past ten years (2013-2023). Since its inception, Bitcoin has recorded 116.01% annualized returns compared to its nearest competitor, the S&P 500 index, which managed 13.48%.

Bitcoin vs. other asset classes

Source: https://www.visualcapitalist.com/bitcoin-returns-vs-major-asset-classes/

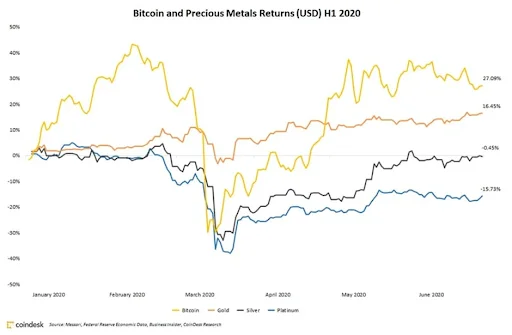

2. Could be a hedge against inflation

Fiat currency is controlled by Central Banks, which can influence it to achieve a favorable outcome. Cryptocurrencies are different as they operate on the principles of decentralization, free from manipulation by any entity.

Cryptos like Bitcoin also go through halving events, which cut down their supply by 50% at set intervals. These measures ensure cryptos do not face the same inflationary pressures triggered by fiat currency supply growth, which could minimize loss of value due to inflation.

C. Why You Should Try Gold

Gold has held a special place in investors’ portfolios for a long time. It is the go-to investment in times of geopolitical and economic uncertainty for various reasons:

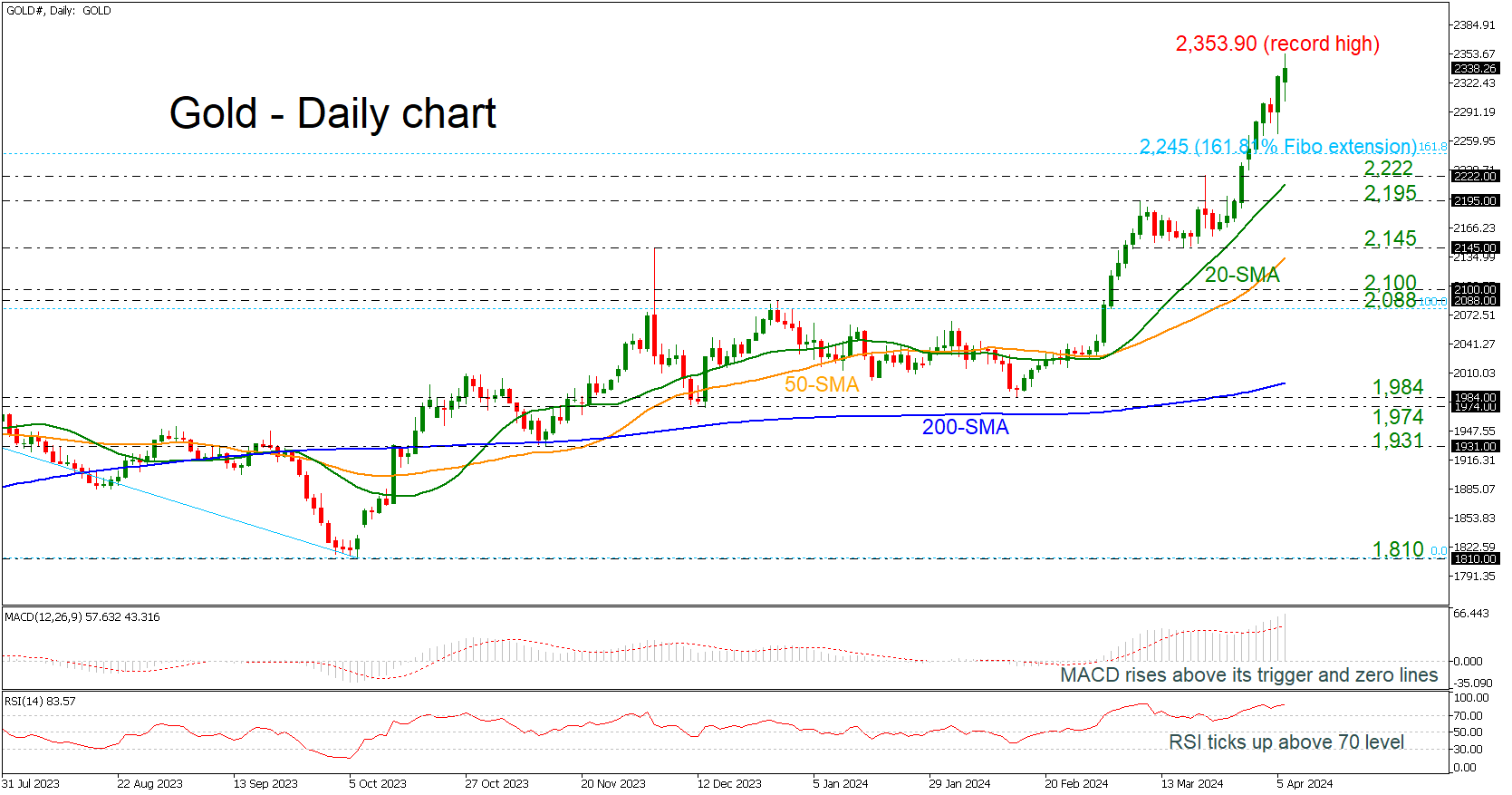

Gold reaches all-time high

1. Hedge against inflation

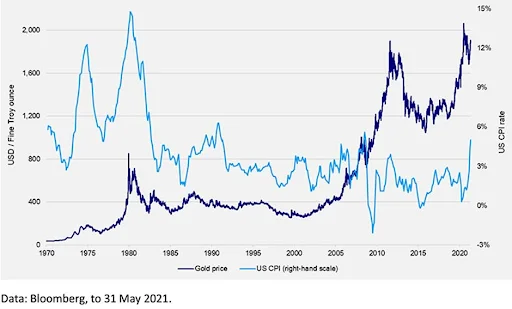

Gold has a proven track record of holding value, making it the perfect medium to hedge against inflation in times of economic turmoil. It has an inverse relation to other types of investments, usually rising in value when the economy is on shaky ground.

For instance, while the value of the S&P plummeted by 56.8% during the 2007-2009 financial crisis, the value of gold rose by 25.5%. Its value increased by 101.1% between 2008 and 2012.

It’s also a great option when faced with market uncertainty. When the Israel-Palestinian conflict began in early October 2023, gold prices gained 6.8% within a few weeks.

While inflation has failed to dial down to the Fed’s target of 2% since 2021, reaching highs of 9.06% in June 2022, gold rose by 8.57% between February and March 2024, easing past $2,300 an ounce, an all-time high.

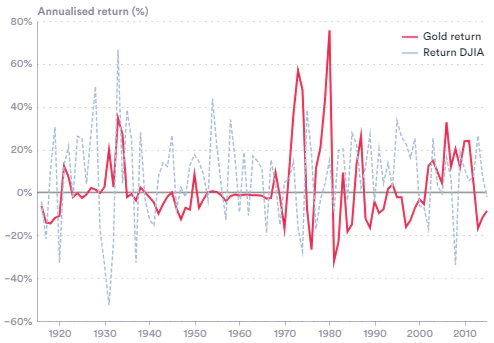

2. Store of value

Gold prices are relatively stable compared to other investment assets like stocks. Using the Dow Jones Industrial Average (DJIA) as an example, gold has outperformed it in 43% of the years between 1925 and 2015, despite only a 2.1% average return annually compared to 7.3% for the DJIA.

Even during times of recession, the two-year average return for gold is about 1.65%, while the DJIA dipped to lows of 55% during the Great Depression in the 1930s. Gold even remains stable in the good times, performing 13% better on average in 26 of the 65 years without a recession.

Gold’s performance over the years

D. Reasons to Invest in Stocks

A 2023 Gallup survey found that 61% of Americans own stocks. Stock ownership, on average, was 62% between 2001 and 2008. The top 1% hold 49.4% (worth $19.7 trillion), while the top 10% own 93% of all stocks. What is the allure of stocks?

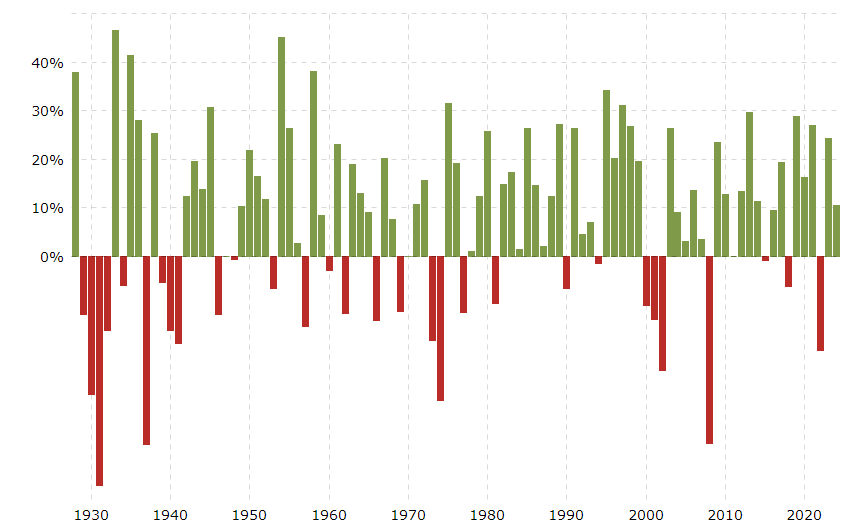

1. Potential for higher returns

While stocks might be perceived as high-risk investments, they also possess the potential for high returns. They certainly provide higher returns than conventional investment options like gold, treasury bonds, and bank deposits.

For example, stocks returned a 10.4% yearly average between 1989 and 2017, compared to just 6.1% for bonds over the same time. Returns from the stock market can go as high as 40% yearly, but beware—they can also dip by as much as 40%.

2. Beat inflation

While stock prices are volatile, they tend to level off in the long run. Therefore, they are a great option as a hedge against inflation for long-term investors. As studied over the past 35 years, the stock market shows a positive return in nearly every 7 out of 10 years.

The average inflation rate has hovered around the 2 to 3% mark for the past 20 years (2003 to 2023), with the long-term inflation rate at 3.1% since 1913. Large domestic stocks recorded an annualized average return of 7.7% (or 9.8% with the dividends reinvested) over the same 20-year period.

Historical performance of the S&P 500

Source: https://www.macrotrends.net/2526/sp-500-historical-annual-returns

3. Promising short-term investment

Nevertheless, one of the biggest draws for investing in stocks is the allure of handsome short-term returns. With luck, investing in stocks can yield astronomical returns.

While extremely rare, it is not unheard of to see a stock’s price jump 100% in a single day. For example, Gateway Industries stock rose 18,000% in a single day in February 2011 following a takeover announcement. Currently, meme stock AMC rose by as much as 120% on May 15, 2024, while GameStop finished the day 60% higher.

4. Liquidity

Stocks are generally perceived as highly liquid assets since you can convert them into cash more easily than investments like real estate.

For instance, the Nasdaq witnesses more than 4.4 million shares traded daily, involving more than 31 million trades. This is several magnitudes higher than the real estate industry, which only experiences about 4 million units traded monthly.

Stocks also list on stock exchanges with nationwide coverage, which means investors usually have a sea of buyers willing to take the stocks off their hands, for the right price.

5. Variety

Investors have a wide array of stocks to choose from, each offering different benefits:

- Common shares: The most common type of equity investment. It offers a chance for capital growth when prices rise, earning dividends, voting for directors who run the company, and advantageous tax treatment.

- Preferred shares: Reliable income stream and dividends paid before common shareholders. It offers higher income compared to common shares, with some allowing investors to plow the dividends back into the company.

A qualified dividend is a common dividend that meets the qualification requirements set by the IRS. Qualified dividends are usually charged at a capital gains tax rate, which can be lower than the income tax imposed on some taxpayers.

Investor Considerations

There’s no one-size-fits-all approach to investing since every investor has a unique set of circumstances that make them suited to one investment approach over another. These should be your top considerations before choosing any of these investment options:

Risk tolerance

Before investing, ask yourself, “How much risk am I comfortable with”? Understand that every investment carries some level of risk, although some are less risky than others.

From the choices above, crypto and stocks are the riskiest due to their high volatility. Gold and real estate are far less risky, so choose what fits your risk management strategy.

Younger investors have time on their hands, so they can either try the riskier options or settle on safer, longer-term options and reap the rewards of compounding.

Investment horizon

How long do you intend to hold your investments? Some investment assets, like stocks and crypto, are excellent for short-term trading, while others, like real estate, only really work if you hang on to them for the long term.

Liquidity needs

If you have no emergency fund, invest in stocks, gold, or the most popular cryptos since they are more liquid. Real estate is off the table as it is less liquid.

Investment goal

What is your goal? Are you aiming for income, capital appreciation, or a combination of both? The answer to this will determine which investment option is best.

For instance, gold might be great for capital appreciation but not for income generation. Most forms of real estate investment offer both appreciation and income, and the same goes for some stocks and cryptos.

Liquidity needs

What is your goal? Are you aiming for income, capital appreciation, or a combination of both? The answer to this will determine which investment option is best.

For instance, gold might be great for capital appreciation but not for income generation. Most forms of real estate investment offer both appreciation and income, and the same goes for some stocks and cryptos.

Conclusion

Stocks, gold, cryptos, and real estate are desirable investment options, each with its own pros and cons. Cryptos and stocks can be great for the short term; gold generally retains its value, while real estate usually appreciates in the long run.

Remember, all investments carry some risk, although some are riskier than others. There’s no universal approach to investing, as the best investment choice depends on your specific goals and financial situation. Exhaustively consider your investment horizon and risk tolerance to make informed choices.

For your own good, consult a financial advisor for personalized advice, especially if you intend to spend huge sums.