The growth of digital twins is one of the most fascinating developments in proptech currently. In 2022, the global digital twin market was worth $3,660.8 million, with a projected growth CAGR of 35.46% between 2022 and 2027, reaching $22,612.42 million.

The digital twin concept has spread throughout the residential, commercial, and industrial real estate sectors. It has the potential to introduce novel efficiencies and reduce operating costs in the long run.

However, real estate developers must adopt a comprehensive strategy to benefit fully from the technology’s potential. This article delves into what digital twin technology is, its place in real estate, and how it could transform the real estate industry.

What is a digital twin?

A digital twin is an identical virtual copy of a physical object, location, or future project. To adapt to and reflect the real-world environment, digital twin technology uses internet of things (IoT) data sensors, machine learning (ML), artificial intelligence (AI), and simulation.

Digital twin technology in real estate

In real estate, a digital twin is a digital representation of a property containing all the relevant features of the actual building and its surroundings.

A digital twin can contain data about a building, such as data from lighting and fire sensor system, floor plans, heating, ventilation, and air-conditioning (HVAC) systems, security system, and tenant interaction data with your building.

How digital twin technology may transform the real estate industry

1. Reduce operational cost

In a recent white paper, EY states digital twins can cut real estate operating expenses by as much as 35%, lower carbon emissions, make workplaces healthier, and enhance user experiences. Operating costs usually include all regular expenditures, such as utilities, maintenance, and repairs.

Lights and HVAC systems may account for 50-70% of operating costs, while energy use accounts for 10-15%. Using digital twins has the potential to increase the transparency of such systems, providing new insights into the impact that users have on environmental outcomes.

You can use the collected data to determine the best way to control the building’s temperature and lighting. The digital twin technology can help optimize operations, which reduces costs without negatively impacting client satisfaction.

2. Foster sustainability

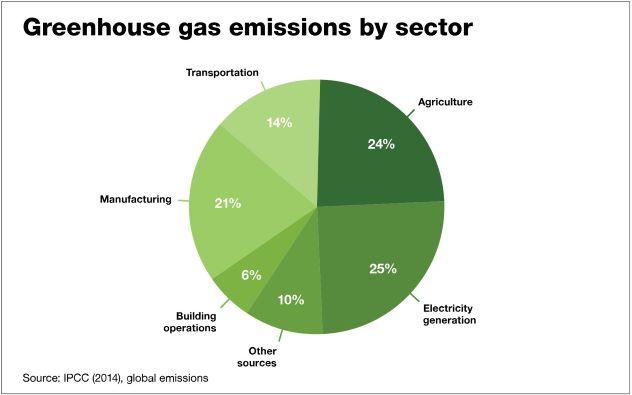

Real estate development usually has many processes, including operations, construction, and design, which generally require economic, social, and environmental sustainability decisions. By 2020, buildings accounted for more than 39% of global energy-related carbon emissions, including 28% from building operations and 11% from building materials and construction.

The digital twin real estate strategy can help improve your real estate business’ environmental footprint. Using the digital twin of your buildings’ ecosystems, you can monitor pollution (such as carbon dioxide CO2 emissions) and waste management.

Additionally, designers can test speculative adjustments to their models, like adopting a greener energy system to gauge its impact in a simulated environment. When you link user data to the twin, you can make adjustments to enhance safety and protect users’ health.

3. Refine the development process

You can program digital twins to simulate your project at any stage of the construction process. That allows you to map out what the building will look like in the future and track its progress to see how closely it matches the ideal design.

Using digital twins also enables better oversight of material usage and equipment. When you completely understand the construction process, variables, and environment, you can optimize operations and maximize productivity.

4. Quicker decision-making

The complicated procedures and diverse factors, such as shifting market dynamics, new legislation, and environmental concerns, usually make decision-making challenging in the real estate industry.

Digital twin technology enables quick and informed decision-making by utilizing cloud-computing technology that uses real-time insights into operational activities. The technology can also serve as a standard for your entire property portfolio and offer advice based on historical data.

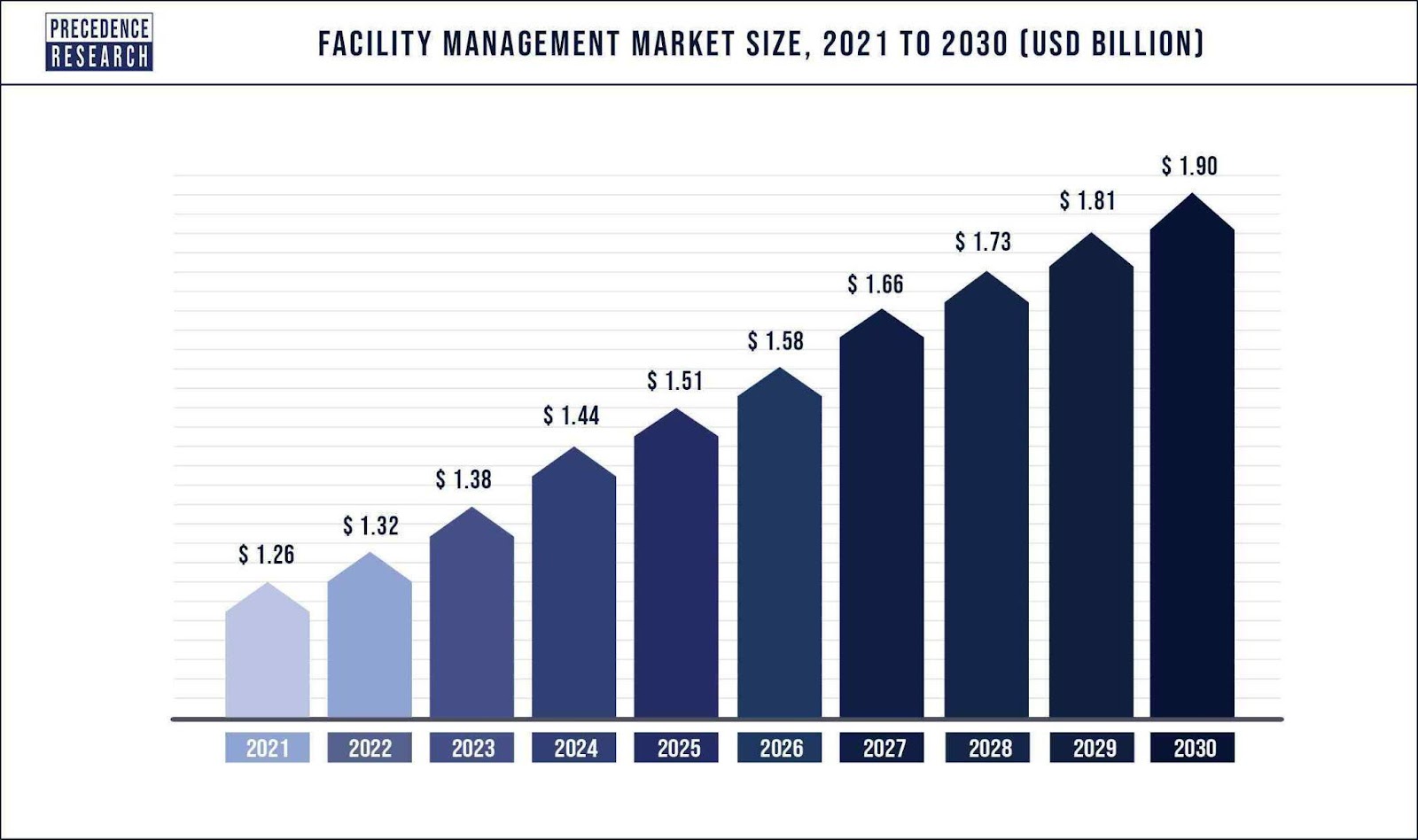

5. Facility management

By simulating new technologies and processes, analyzing performance concerns, and gaining predictive insights, digital twins help you build a more productive and environmentally friendly workspace. And the data shows 63% of companies use analytics to enhance productivity and efficiency.

You can use a building’s digital twin to design floor plans that optimize the natural light your facility receives. That will also foster an environment where plants thrive, and encourage collaboration while ensuring everyone’s comfort.

When you combine tenants’ preferences with ML, it becomes simpler to design a maintenance plan that reduces expenses through automated procedures, cutting down on labor and utility expenses and remote monitoring. Through digital twins, you may gain insight into predictive maintenance and handle any problems before they occur.

6. Improved communication

Using the digital twin as a portal to data provides you with real-time information and a holistic perspective with complete transparency.

The digital twin connects to the IoT, allowing machine data and real-time sensors usage, technical data for installation, performance and material employment, digitalized design data for buildings and other valuable data sources to create an improved product.

High-speed calculation speeds enabled by digital twins allow quick problem identification and resolution, improving reliability, security, and user satisfaction. Additionally, the digital twins serve as an open communication channel for all ecosystem users, promoting both collaborative innovation and collective insight.

7. Enhanced user experience

As a real estate developer, you should heavily factor your clients’ needs and wants into your decisions and strategies. With the help of digital twins, you can better determine your clientele needs and respond with innovative new offerings.

Since many clients now expect tailored experiences, niche real estate markets have a place in the digital value network. There’s a market shift towards individualized units to help meet the needs of each home buyer, meaning mass production of homes is off the table. An Epsilon survey shows that 80% of consumers are more likely to purchase from a company that offers personalized experiences.

Digital twins also allow real estate companies to quickly identify and fix problems, improving customer experience. Developers can find issues and provide excellent products by creating a connected digital twin.

Final word

With all these potential transformations in the real estate industry, it looks like the digital twin is here to stay. These 3D models are a massive step in the real estate industry, helping with everything from decision-making to streamlining day-to-day operations.

Investing in real estate is no longer a secret kept for the nation’s ultra-wealthy! People like you are participating in the action and taking advantage of the numerous benefits of real estate investment.

While the commercial real estate sector is going through a transition, we’re keeping our eyes on what’s important: solid fundamentals. When you’re allocating your hard-earned funds, think long-term and keep it all in perspective.

When you are ready to reap the rewards of real estate investing let’s talk.